Poster

1905 movie network news After the recent announcement of the Olympic beautiful woman reporter Xiong Li, the new generation of actresses and the son of the famous Chinese director Li An Li Chun to join the new work, director Han Han once again released a big move today: confirming Peng Yuyan’s participation in "Riding the Wind and Breaking the Waves" – this blockbuster news instantly aroused a thousand waves of heated discussion among netizens, exclaiming that Han Han actually has such a "killer".

From finding another way to announce the behind-the-scenes lineup first, to singing and songwriter Li Ronghao’s singing and excellent performance, and then to the grand debut of Golden Eagle Muse Zhao Liying, and then teaching Yi Xiaoxing and Xiong Li and other network celebrities to participate in the performance, and finally to the grand finale of the son of the director, Han Han’s process of announcing the actors this time can be described as ups and downs and step by step shocking, unexpected and surprising, itself is a good table of dinner, a good game of chess, a big play.

With the 12 people announced so far, Han Han has become a chef and served a cross-border "hodgepodge" – a cast that includes movie actors, TV actors, singers, internet celebrities and sports journalists, plus his two pet dogs.

Next, I will introduce each dish in order and guess the intention of Chef Han Han.

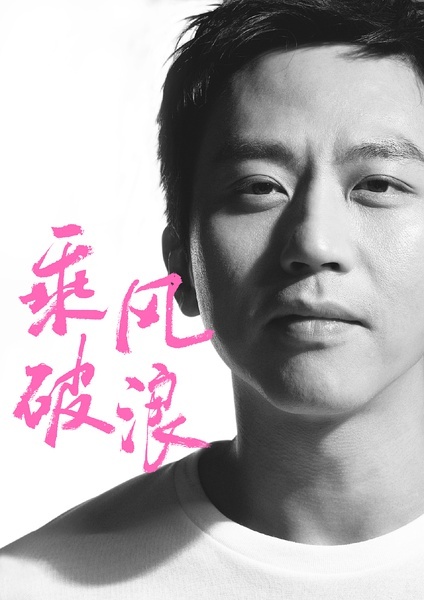

Deng Chao

Deng Chao, who is now an actor, film director, variety show MC, and investment producer, has long been waiting for his works to prove his acting skills and plasticity, and has received corresponding awards and nominations.

Last year, Deng Chao, Duan Yihong and Guo Tao won the Golden Goblet Best Actor "Three Yellow Eggs" for their wonderful performances at the Shanghai Film Festival

This time, Deng Chao will play the role of race car driver Xu Tailang, believing that this role will bring Han Han’s own shadow and growth experience, which is undoubtedly expected. As a popular appeal and acting role, he will bear the brunt of the "Riding the Wind and Breaking the Waves" cast list.

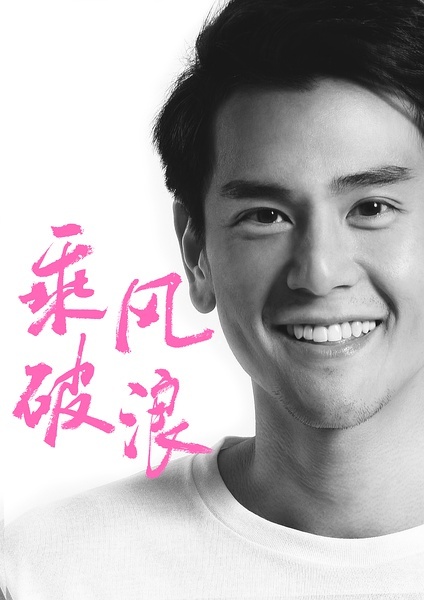

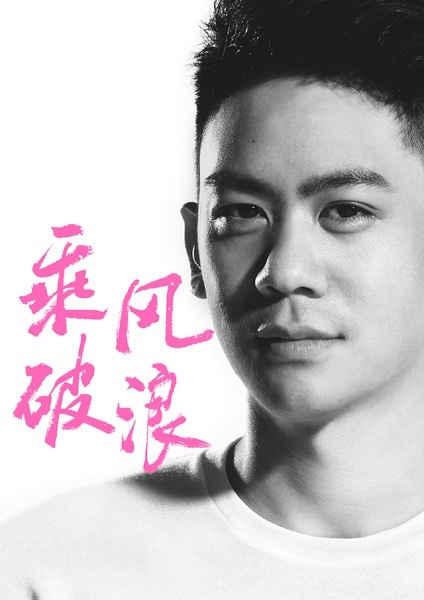

Dong Zijian

He Luhan, Wu Yifan, and Yang Yangtong were named "the four post-90s students" by Taiwan’s ETtoday website and Malaysia’s World News. This was enough to prove Dong Zijian’s high popularity. However, his debut was due to many awards and nominations. Last year, he was nominated by the Golden Horse Best Actor, and his acting skills were enough to get rid of the other three students. N streets.

Dong Zijian was much praised

The appearance of Dong Zijian, who is popular and powerful, seems to have locked in the literary and artistic atmosphere of the movie in advance, and is likely to follow the model of setting Deng Chao and his double male protagonist. From the age analysis, it is also very likely that there will be a father and son confrontation in the movie.

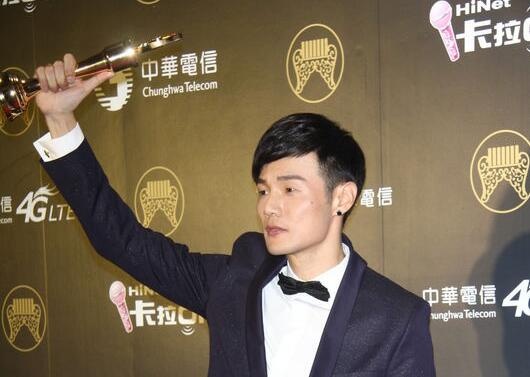

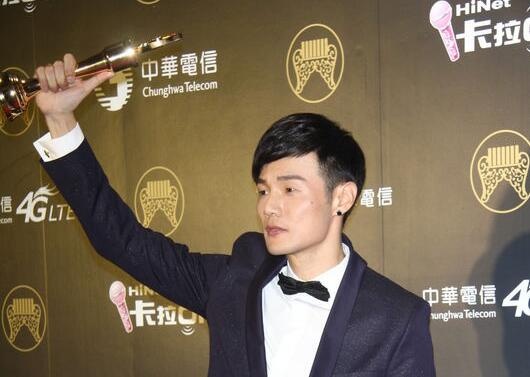

Li Ronghao

Since the album was nominated for five awards at the 25th Golden Melody Awards and won the Best Newcomer Award in one fell swoop, the mainland singer-songwriter who is reminiscent of Jay Chou from looks to talent to popularity has now been upgraded to a music producer.

Li Ronghao won the Best Newcomer Award at the 25th Golden Melody Awards

Li Ronghao, who was electrocuted for the first time in "Riding the Wind and Breaking the Waves", will presumably attract the curious attention of fans and turn it into a real box office, and will also be able to arrange all the soundtrack creation and singing of the film.

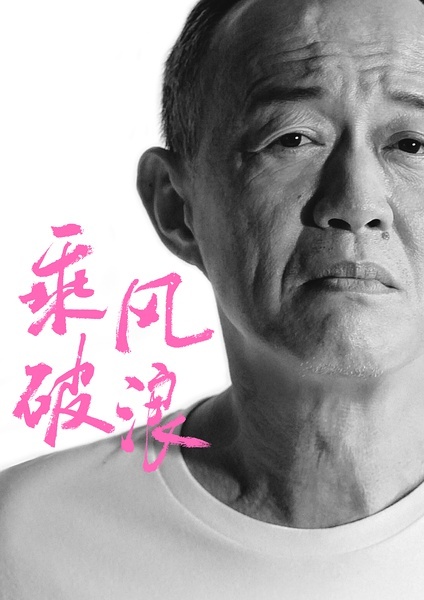

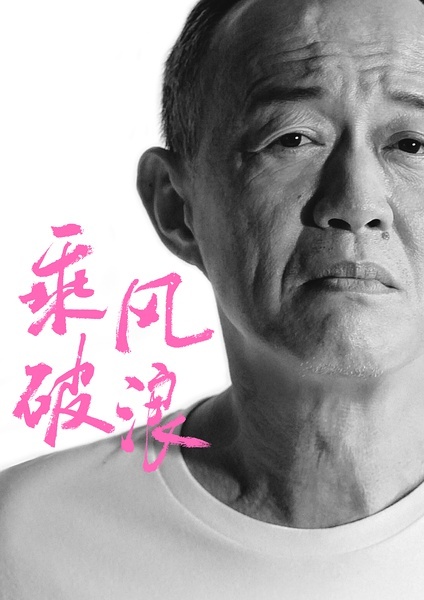

Jin Shijie

As the grandson of the former Kuomintang Central Committee, he is one of the important theater promoters and core creators in Taiwan, as well as a pioneer and a hall-level representative. He has excellent speaking skills and superb performance skills, and is known as the "Eternal Jiangbin Liu" by movie fans. Teacher Jin Shijie has cooperated with Yang Dechang, Wang Jiawei and other major directors many times, and his works are familiar to mainland audiences. He also won the Best Supporting Actor at the Beijing Film Festival this year for his outstanding performances.

In, Jin Shijie plays Zheng Shanao

Even the wrinkles in the corners of the eyes on the poster can see the acting skills of the old actor Jin Shijie, who will undoubtedly be used as the "Sea God Needle" for the performance of "Riding the Wind and Breaking the Waves", which is enough to make the audience look forward to the "drama" between the powerful actors in this movie.

Zhao Liying

Zhao Liying, as a popular flower, has broken the definition of a beautiful and cute girl with the reverse role of Liuli in the movie that subverts the sweet image, and this year can be called its screen harvest year, a record-breaking "Flower Thousand Bones" and a super popular "Old Nine Doors" both won awards, and let it be crowned Golden Eagle Muse.

In, Zhao Liying plays the traitor Liuli

As a popular and the first female cast to appear, Zhao Liying is almost certain to be the heroine of "Riding the Wind and Breaking the Waves". In Han Han’s last work, Wang Luodan’s stunning glimpse, Yuan Quan’s free and easy, and Chen Qiaoen’s intellectual gentleness all left a deep impression on the audience. This time, the performance of the Golden Eagle Muse is undoubtedly expected.

Zhang Benyu, Professor Yi Xiaoxing

Then came the "never expected" time – as one of the leading actors of Wanhe Tianyi, whether it is Liu Bei, the hero of the Three Kingdoms, or Duan Zhengchun, the giant of the Tianlong, Zhang Benyu can inject just the right "cute" element into his image through his own interpretation; and from the most popular original author on the Internet to the comedy director, Professor Yi Xiaoxing always seems to be able to grasp the laughs and pulse of the generation that has grown up on the Internet.

Han Han also starred as a white dragon horse in a big movie

As the royal cameo of Han Han’s film, Bai Ke and Kong Lianshun appeared in "Future Meeting", and it is not uncommon for Zhang Benyu and Professor Yi Xiaoxing to appear in "Riding the Wind and Waves".

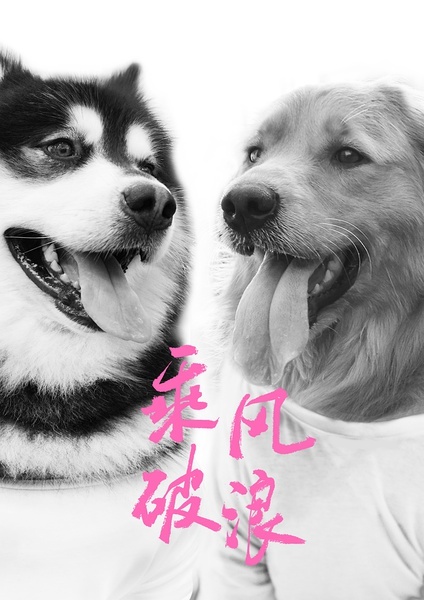

Madagascar, period

It’s time for cute dogs! Madagascar became famous for starring in "Future Meeting Indefinite", contracting the biggest attraction of the entire movie, and became a "generation superstar" in the pet industry; the other Han Han’s dog who appeared with Mada happened to be Mada’s "love rival" for many years, and there were even rumors that said: "Han Han once wanted to play the role of Mada in" Future Meeting ", but he had no choice but to give up because his golden fur was too similar to the desert." And the relationship between the name of the period "period" and "Future Meeting Indefinite" seems to confirm this statement.

Chen Bolin and Madagascar in "The Future"

The two dogs had previously conducted several rounds of act cute index contests on Weibo, and this time they met again in the movie. Who has more scenes, more popularity, and better acting skills? The answer can only be revealed when the movie is released.

Gao Huayang

As Han Han’s racing teammate, a joke launched the acting career of the trophy-winning racer – Gao Huayang’s role as Hu Sheng in "Infinite Future", although the role is not large, its "inexplicable disappearance" in the film is very impressive. "Where has Hu Sheng gone" has also become one of the important plots that fans and friends have discussed and deciphered after watching the movie.

Gao Huayang, Feng Shaofeng and Chen Bolin in The Future

In this "Riding the Wind and Breaking the Waves", Gao Huayang "came out of the mountain again". Whether to play the ticket or officially step into the road of interpretation is still unknown.

Xiong Li, Li Chunai

The beautiful sister flower is on the scene! Xiong Li, a sports reporter, randomly interviewed a young handsome guy in the auditorium of this year’s Olympic Games, but unexpectedly it was Wu Minxia’s boyfriend. This sudden situation quickly made Xiong Li popular on the Internet and was called the most beautiful female reporter in China’s sports world. Another actress, Li Chunai, graduated from Nortel and starred in the convenience store girl who was kidnapped in 2015. She also played with Lin Gengxin in the hit TV series "Zhao Zilong" in the first half of this year.

At the Rio Olympics, Xiong Li accidentally interviewed the boyfriend of diver Wu Minxia

Although Xiong Li’s participation in "Riding the Wind and Breaking the Waves" as an Internet celebrity live streaming host has caused a lot of controversy, the saying goes that "three women have one play" makes us expect Zhao Liying, Xiong Li and Li Chunai to recreate or even surpass the beautiful memories brought to us by Chen Qiaoen, Wang Luodan and Yuan Quan in "The Future Will Be Indefinite".

Li Chun

In recent years, Li Chun has mainly developed in Hollywood, and he has made guest appearances and also participated in the blockbuster film "Billy Lynn’s Halftime War" directed by Li Ang. Recently, Li Ang took his son to promote all over the world, and revealed that his personality is very similar to his own, and he has a hard-working and hard-working personality. Li Chun also received language and martial arts training in Beijing and Taiwan, and will tilt the focus of his future career entirely to the domestic. Every time he is discussed with his father Li Ang in the media, Li Chun accepts it calmly: "I can’t control this. So, I can only continue to act and accumulate works, hoping to find my identity." And since the age of two, he has been making cameo appearances, and after being honed in many works, he has also been admitted by his mother, "He is very talented, and after so many years of hard work, he has finally achieved something."

Li An and his son Li Chun

Choosing Han Han’s "Riding the Wind and Breaking the Waves" to cooperate with a group of excellent Chinese actors must be the result of Li Chun’s deliberate consideration. He hoped that he could absorb more acting experience and familiarize himself with the domestic film and television environment. Han Han, on the other hand, could use this opportunity to promote future cooperation with director Ang Lee while leveraging the novelty of the domestic audience towards Ang Lee’s son.

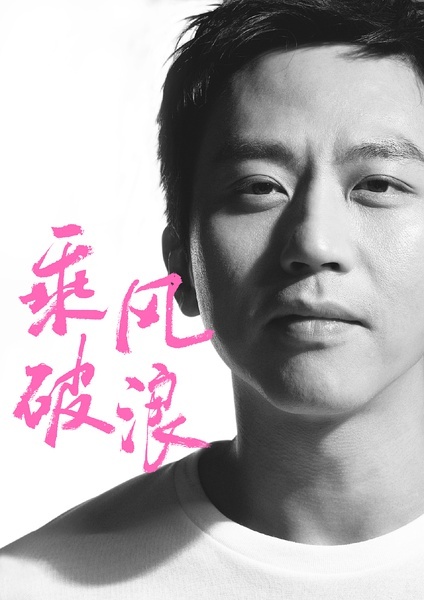

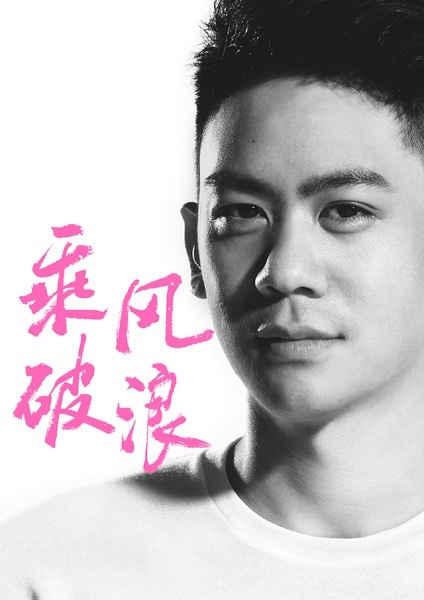

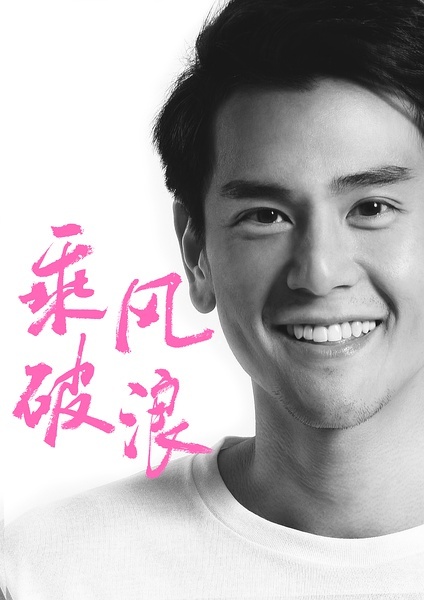

Peng Yuyan

Peng Yuyan has a handsome appearance, a healthy image, and youthful vitality. He can be fresh before and after the moon, and he can also fight hard with his blood. Not long ago, the main melody blockbuster relied on perfect word-of-mouth to counterattack all the way in the National Day file, and finally received 1.10 billion high box office, breaking the box office record of Chinese police and gangster films. As the lead actor, Peng Yuyan successfully created Fang Xinwu, a iron-blooded tough man, in "Mekong Action", which won praise and screams from countless fans. From Ashin, who challenged gymnastics in 2011, to Lin Siqi, who was determined and unbreakable in 2013, to the inspirational driver Qiu Ming in mid-2015, and Li Jiajun, the "fallen police officer" in this summer, Peng Yuyan relies on these characters to break everyone’s stereotypical impression of him, and has become a strong acting school that strives to create a plump three-dimensional and memorable character.

Peng Yuyan in "Operation Mekong"

Peng Yuyan’s joining not only adds to the appearance of the entire cast, but also symbolizes the determination of "Riding the Wind and Breaking the Waves" to impress the audience with strength. And with Peng Yuyan’s thriving development momentum and explosive popularity, it obviously increases the confidence and guarantee for the box office of "Riding the Wind and Breaking the Waves".

Okay, the above is the latest dish of Chef Han Han carefully interpreted by Xiao Dianjun for everyone – "Riding the Wind and Breaking the Waves" is stewed in a mess. I wonder if the guest officials are still satisfied?