The dark horse enterprises that used to be in the new energy automobile market can be said to have lost their scenery recently.

An email of "Notice of Termination of Guangzhou Automobile Ai ‘an Campus Recruitment" put Ai ‘an on the hot search list.

According to the e-mail, due to the adjustment of the recruitment policy of fresh graduates, the signed tripartite agreement/bilateral agreement was cancelled, and the liquidated damages of 5,000 yuan were paid to the cancelled person.

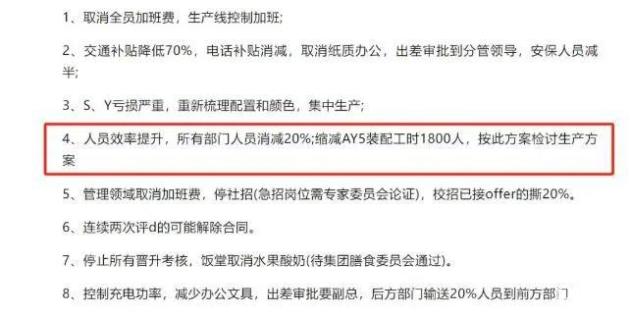

Before the news that "intensive and fresh graduates canceled the contract", Ai ‘an was also exposed to the rumor of "20% layoffs".

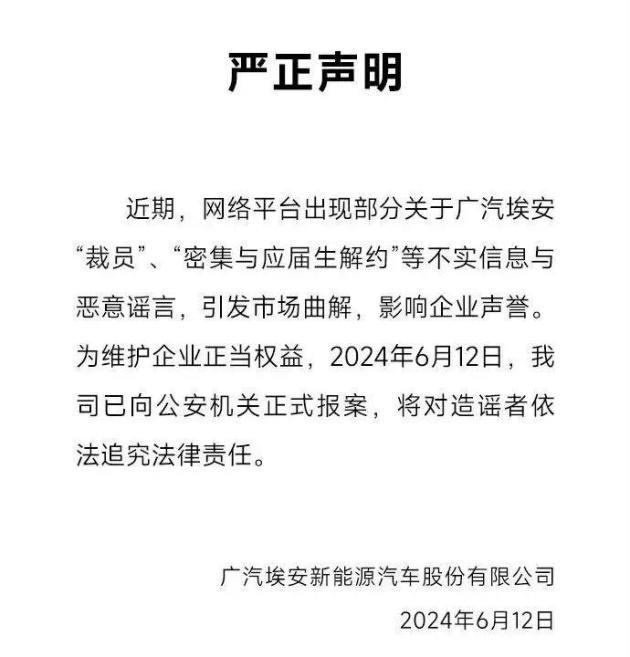

In the face of all kinds of rumors, Ian responded quickly.

"There are only more than 7,000 employees in Ai ‘an, and 20% of layoffs are 1,400. Are they all going to be fired? It is really a malicious smear. " Gu Huinan said.

While rumoring, Ai ‘an also officially reported the case to the public security organ, and the rumour maker will be investigated for legal responsibility according to law.

Rumors may be rumors, but it is an indisputable fact that the sales volume of Ai ‘an has declined this year.

The data shows that from January to May, 2024, the sales volume of Ai ‘an was less than 110,000 vehicles, a year-on-year decrease of 38.71%, which was far from the annual sales target of 700,000 vehicles.

Deal with rumors and call the police. Grab food with your opponent, and you can only find your way forward by yourself.

To tell the truth, although Ai ‘an has not been very conspicuous this year, it has been remarkable for most of its short corporate history.

Among the new brands created by traditional established car companies, Ai ‘an is the fastest and best-performing.

Founded in July 2017, Guangzhou Automobile Ai ‘an shoulders the heavy responsibility of developing the pure electric new energy automobile business of Guangzhou Automobile Group, and Ai ‘an did not disappoint Guangzhou Automobile Group.

The data shows that from 2019 to 2022, the annual sales volume of GAC Ai ‘an was 42,000, 60,000, 123,700 and 271,000 respectively.

In 2023, it was a year when Ai ‘an broke out completely.

In this year, the annual sales volume of Ai ‘an soared to 480,000 vehicles, up 77% year-on-year, becoming the third largest new energy brand in China and the fastest pure electric vehicle brand with production and sales exceeding one million in the world.

Not only is the sales volume gratifying, but Ian also knows how to make sound.

Feng Xingya, the general manager of GAC, once shouted: "GAC Ai ‘an wants to change the current’ Wei Xiaoli’ into’ Ai Xiaowei’."

In addition, on April 14th, the year before last, Mercedes-Benz announced its electric concept car, with a measured battery life of 1,008 kilometers.

Guangzhou Automobile Ai ‘an quickly followed up and sent a Weibo: "The 1000km pure electric Zhixing Club is recruiting again."

Because the cow blew too hard, Ian was even criticized by industry experts.

Ou Yangming Gao, a power system expert, said: "If someone says that his electric car can run for 1,000 kilometers and be fully charged in a few minutes, it is particularly safe and the cost is very low, you don’t have to believe it."

In order to prove that his technology is not a fool, Gu Huinan broke his fingers at the press conference to analyze his battery technology for the public, and was also sent to the Internet by a screenshot of a caring person, saying that Gu Huinan’s industry experts held the middle finger.

The menacing Ian can’t let colleagues pay attention.

LI, who was equally prosperous last year, often deliberately kicked Ai ‘an out of the new power sales list when publishing weekly or monthly sales lists, so that he was the first.

Some people say that Ai ‘an is backed by the traditional Guangzhou Automobile, which is not a new force in a strict sense, but the key point is that there are BYD and Geely poles on the list. It is obviously a bit unreasonable to kick Ai ‘an out.

Of course, whether you are on the list or not can’t stop Ai ‘an’s new energy market.

Xiao Yong, deputy general manager of Ai ‘an, even boasted: "We also want to keep a low profile, but our strength does not allow us to keep a low profile".

All the way forward, it is obvious that Ian is full of confidence in the future. At the beginning of this year, Gu Huinan set an ambitious annual sales target for the company-

"Guarantee 700,000 vehicles and strive for 800,000 vehicles."

Now it seems that Ai ‘an’s expectation for 2024 is too optimistic.

In fact, in the last few months of last year, the momentum of Ai ‘an has weakened. In September 2023, the monthly sales volume of Ai ‘an exceeded 50,000 vehicles, but in October, the sales volume dropped to 42,000 vehicles. Moreover, at the critical moment of the year-end sales volume, Ai ‘an failed to break the previous record, always hovering between 41,000 and 46,000 vehicles.

By 2024, the involution degree of the new energy vehicle market is beyond imagination.

The hardest thing to do is BYD.

In February, with the slogan of "electricity is lower than oil", BYD presented the 2024 glory version of Qin PLUS DM-i with a price of 79,800 yuan, and the glory versions of other models also had a decline of 10,000-50,000 yuan. Not long after, Wuling Automobile, Chang ‘an Qiyuan, Nezha Automobile and other car companies also announced their follow-up, and set off a bloody storm in the new energy automobile market within 100,000 yuan.

Since then, there have been several price cuts, which have made many old car owners feel "backstab". Among them, BYD’s new car released at the end of last month has a fuel consumption of 2.9L per 100 kilometers and a comprehensive battery life of 2,100 kilometers, and the price is only 9.98-13.98 million yuan, which is even more shocking to the industry.

These actions are gradually shaking one of the basic disks of Ai ‘an: the network car.

The reason why Ai ‘an got off to a rapid start is that the network car has made a great contribution.

For a long time, Ai ‘an has delivered mainly vehicles with a price of less than 200,000 yuan, which is very popular with drivers.

In this way, Ai ‘an has become the main force in the field of online car and taxi, and has also been dubbed by netizens as a new energy car brand that "knows the middle-aged unemployed best".

According to the data of CITIC Securities, from 2020 to the first half of 2021, the sales of AION S, the main model of Guangzhou Automobile Ai ‘an, accounted for 60% to 70% in the rental market. In 2023, Ai ‘an’s network car attributes became stronger. According to media statistics, among the 850,000 new cars with network car in that year, GAC Ai ‘an topped the list with sales of nearly 220,000 vehicles.

It has been a long time since it was tied to the network car, and the brand of Ai ‘an seems to be somewhat cheap to many consumers.

But Ian doesn’t think so. After all, he can run around the street all day as a network car, and the quality is definitely up to standard.

Gu Huinan once publicly stated that "the network car is not synonymous with low-end." Xiao Yong of Ai ‘an put it more directly: Ai ‘an will never give up the online car market. If you ask Tesla to take a look at the online car, he may run away in three months.

However, no matter how you look at the online car model, the good days are over after all.

On the one hand, more and more peers are eyeing this cake, and the competition of 100,000-class and 150,000-class network models is becoming more and more fierce. Lian Xiaopeng Automobile also announced that the brand of "MONA", a pure electric car that cooperates with Didi, will start mass production in 2024, and the sword refers to the network car market.

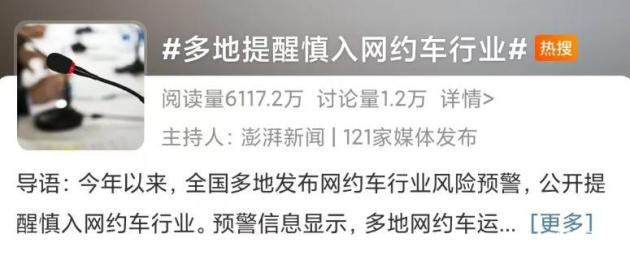

On the other hand, the network car market is gradually saturated with limited increment. Last year and this year, many places across the country issued risk warnings for the network car industry, publicly reminding them to be cautious.

The old road on which to make a fortune is getting harder and harder, and Ian urgently needs to find a new one.

The new energy vehicle market has entered the knockout stage, and then it will only roll up.

In such an environment, Ian actually prepared two ways for himself early in the morning.

The first is to go to sea.

When responding to rumors of "layoffs" not long ago, Gu Huinan also said that this year’s Thai factory, Indonesian factory and Changsha factory in Ai ‘an will be put into production one after another, and they are all recruiting people.

In the next 1-2 years, Aeon will also build production bases in Europe, South America, Africa, the Middle East and other countries. According to the plan of GAC Ai ‘an, the export sales volume of Ai ‘an will reach 5%-10% in 2024. "Export products are better than domestic products in terms of price and brand premium, so export is the most worthwhile thing to do."

The second is the impact of high-end.

In September 2022, Ai ‘an released a brand-new high-end brand Hyperplatinum, and simultaneously launched the first model Hyper, with a price of 1.286 million-1.686 million yuan. In order to match the positioning of high-end brands, at that time, Aian used all housekeeping technologies, including high-performance integrated electric drives, 900V silicon carbide chips, aviation-grade tires, and wind-power transmission shafts …

In the second half of 2023, Haobo launched two models for mass market and positioned the pure electric market of 200,000-300,000.

However, these two roads are not destined to be shortcuts to get rid of difficulties or upgrade.

Going out to sea to enter new countries and regions needs to face the new environment and different consumer demands. Even consumers in some countries are not interested in electric vehicles at all, and every item is a challenge. At the same time, Chery, BYD and other domestic car companies have already rolled overseas, and they can’t get rid of the entanglement of their old rivals as far away as Wan Li.

High-end is even more difficult.

One month after listing, millions of luxury cars began to be delivered, but so far the official has not announced their sales. Some insiders predict that from listing to production suspension, Haoplatinum SSR may have sales of about 300 units. In contrast, BYD sold 608 vehicles in May this year, and the cumulative sales volume has reached 7083 vehicles since its listing and delivery.

Even the relatively cheap Haoplatinum GT and Haoplatinum HT have not been able to carry the banner for the time being. In 2023, the sales volume of Haoplatinum was only 5,251 vehicles.

High-end needs to break through in all aspects such as technical strength, product design and brand design, and at least one or two key places should be able to open a clear gap with their peers. And these will undoubtedly take time to precipitate.

But in today’s new energy vehicle market, time may really wait for no one.

Every moment, no one can relax, and no one has a good way to go.

No matter whether it is going out to sea or high-end, the road ahead of Ai ‘an is by no means.